Ever wondered why your monthly health insurance premium is nearly the size of a car payment? You’re not alone. The average American shells out $456 per month for individual coverage, while families are staring down a whopping $1,152.

Look, I get it. Health insurance costs in the USA feel like they’re designed by people who’ve never had to choose between medication and groceries.

In the next few minutes, I’ll break down exactly what drives these astronomical health insurance costs and show you practical ways to find coverage that won’t require a second mortgage.

The numbers aren’t just statistics—they’re your money. And they vary wildly depending on where you live, your age, and whether your employer chips in.

But here’s the question keeping insurance executives up at night: What happens when Americans simply can’t afford to pay anymore?

table of contents

- 1 Understanding Health Insurance Costs in America

- 2 Types of Health Insurance Plans and Their Cost Differences

- 3 Hidden Costs Beyond Monthly Premiums

- 4 Affordable Care Act’s Impact on Insurance Costs

- 5 Strategies to Reduce Your Health Insurance Expenses

- 6 Special Considerations for Different Demographics

Understanding Health Insurance Costs in America

Health insurance in America isn’t cheap—not even close.

Right now, the average individual is paying around $456 per month for health insurance. That’s over $5,400 a year just to have coverage! For families? The numbers get even more eye-watering. The typical family premium sits at about $1,152 monthly, which adds up to nearly $14,000 annually.

But those are just averages. The truth is, what you’ll actually pay depends on:

- The type of plan you choose

- Your age

- Your location

- Whether you get insurance through an employer

People with employer-sponsored plans typically pay less out-of-pocket since companies cover about 80% of individual premiums and 70% of family premiums. If you’re buying on your own through the ACA marketplace, those premiums might hit your wallet harder.

B. How costs vary by state and region

Your zip code matters—a lot. The difference between insurance costs across states is shocking.

States with the highest premiums:

- West Virginia ($712/month)

- Wyoming ($665/month)

- Vermont ($655/month)

States with the lowest premiums:

- Georgia ($371/month)

- New Hampshire ($378/month)

- Maryland ($381/month)

That’s nearly a $340 monthly difference between the most and least expensive states!

Urban areas often have more competition among insurers, which can drive down prices. Rural regions? They typically face higher costs due to fewer providers and less competition. The Northeast and West Coast generally have higher premiums than the South and parts of the Midwest.

Insurance companies aren’t just pulling numbers out of thin air when setting your premiums.

Age is huge—older adults can pay up to three times more than younger people for identical coverage. A 60-year-old might pay $950 monthly while a 21-year-old pays $350 for the exact same plan.

Tobacco use slaps on another surcharge—smokers pay up to 50% more than non-smokers.

Other major factors include:

- Plan category (Bronze, Silver, Gold, Platinum)

- Family size (adding dependents increases costs)

- Provider networks (broader networks = higher premiums)

- Deductible amounts (lower deductibles = higher monthly payments)

And no, insurers can’t charge you more based on gender or pre-existing conditions thanks to the ACA.

D. Historical trends in health insurance pricing

Health insurance costs have been climbing steadily for decades—but the pace has accelerated.

In 2000, the average family premium was about $6,000 annually. Today? It’s more than doubled. Individual premiums have grown at a similar clip.

Between 2010-2020, premiums increased roughly 55%, far outpacing both inflation and wage growth. During this period, the average worker’s earnings increased only about 27%.

What’s driving this upward spiral? A perfect storm of:

- Rising prescription drug costs

- Expensive medical technology

- Administrative overhead

- Hospital consolidation

- An aging population with more health needs

The pandemic temporarily slowed premium growth in 2020-2021, but prices are climbing again. Most experts predict continued increases of 5-7% annually in the coming years—with no ceiling in sight.

Types of Health Insurance Plans and Their Cost Differences

A. Employer-sponsored plans vs. individual market plans

Health insurance costs hit your wallet differently depending on where you get your coverage.

Employer plans are typically cheaper because your company foots part of the bill. On average, employers cover about 80% of premium costs. In 2023, workers paid around $1,350 annually for single coverage and $6,440 for family coverage—while the total premium averaged $8,435 and $23,968 respectively.

Individual market plans? That’s a whole different story. Without an employer subsidy, you’re looking at the full premium yourself. Marketplace plans without subsidies average about $7,920 annually for individuals and a whopping $22,800 for families.

Here’s a quick breakdown:

| Plan Type | Average Monthly Cost (Individual) | Average Monthly Cost (Family) |

|---|---|---|

| Employer | $113 | $537 |

| Individual Market | $660 | $1,900 |

The gap is massive, but ACA subsidies can help bridge it if your income qualifies.

B. HMO, PPO, EPO, and POS plan cost comparisons

The alphabet soup of health plans each comes with its own price tag:

HMOs (Health Maintenance Organizations) are typically the cheapest option, averaging $454 monthly for individuals. They limit you to in-network providers and require referrals from your primary doctor, but those restrictions help keep costs down.

PPOs (Preferred Provider Organizations) give you more freedom to see specialists without referrals and use out-of-network providers—but you’ll pay for that flexibility, with average premiums around $596 monthly.

EPOs (Exclusive Provider Organizations) fall somewhere in between at about $511 monthly. They don’t cover out-of-network care except in emergencies, but you don’t need referrals.

POS (Point of Service) plans blend HMO and PPO features, with average costs around $540 monthly. They require referrals but offer some out-of-network coverage.

C. High-deductible health plans and HSA options

High-deductible health plans (HDHPs) might make you sweat at first glance. Your deductible (what you pay before insurance kicks in) must be at least $1,500 for individuals or $3,000 for families in 2023.

But here’s the upside: premiums are significantly lower, often 15-20% less than traditional plans.

The real magic happens when you pair an HDHP with a Health Savings Account (HSA). These accounts let you save pre-tax dollars for medical expenses. In 2023, you can contribute up to $3,850 (individual) or $7,750 (family).

The triple tax advantage is pretty sweet:

- Tax-free contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

For healthy folks who rarely see doctors, this combo can save serious cash.

D. Medicare and Medicaid cost structures

Once you hit 65, Medicare enters the chat. The basic breakdown:

- Medicare Part A (hospital insurance): Free for most people who paid Medicare taxes while working

- Medicare Part B (medical insurance): $164.90 monthly standard premium in 2023

- Medicare Part D (prescription drug coverage): Averages $31.50 monthly

Many seniors add Medicare Supplement (Medigap) policies, which cost $150-$200 monthly on average, to cover gaps.

Medicaid costs vary dramatically by state but generally provide free or very low-cost coverage for qualifying low-income Americans. Eligibility is typically based on having income below 138% of the Federal Poverty Level in expansion states.

E. Catastrophic coverage options for young adults

If you’re under 30 or qualify for a hardship exemption, catastrophic plans offer bare-bones protection against worst-case scenarios.

These plans have super low premiums—often 20-30% cheaper than Bronze plans—but sky-high deductibles (typically around $9,100 in 2023).

You’ll get three primary care visits covered annually before meeting your deductible, plus free preventive care.

For healthy twenty-somethings on tight budgets, these plans provide affordable protection against medical disasters while paying out-of-pocket for routine care.

Hidden Costs Beyond Monthly Premiums

Understanding deductibles, copays, and coinsurance

Think your monthly premium is all you’ll pay for health insurance? Think again.

Your health insurance comes with a whole menu of extra costs that can blindside you if you’re not prepared. Let’s break down these sneaky expenses:

Your deductible is the amount you pay before your insurance kicks in. Say you have a $2,000 deductible – you’re covering every penny of medical expenses until you hit that mark. Only then does your insurance start sharing costs.

Copays are those fixed fees you pay at each doctor visit. They typically range from $20-50 for primary care and $30-75 for specialists. Seem small? They add up fast when you’re managing a chronic condition.

Coinsurance is the percentage split between you and your insurer. A typical arrangement is 80/20 – your insurance covers 80% of costs after deductible, and you’re on the hook for the remaining 20%. For expensive procedures, that 20% can mean thousands of dollars.

Out-of-pocket maximums explained

The out-of-pocket maximum is actually your financial safety net. Once you spend this amount on deductibles, copays, and coinsurance, your insurance covers 100% of remaining costs for the year.

In 2023, ACA plans cap out-of-pocket maximums at $9,100 for individuals and $18,200 for families. That’s still a huge chunk of change!

The real kicker? Not all expenses count toward this limit. Many plans exclude:

- Monthly premiums

- Out-of-network care

- Services not covered by your plan

Network restrictions and out-of-network costs

Insurance companies build networks of doctors and facilities they’ve negotiated rates with. Step outside this network, and your wallet takes a serious hit.

Out-of-network providers might charge you:

- Higher deductibles (often double the in-network amount)

- Higher coinsurance (commonly 40-50% instead of 20%)

- Balance billing (the difference between what providers charge and what insurance pays)

Emergency care at an in-network hospital? Great. But what if the anesthesiologist who helped during your procedure isn’t in-network? Surprise bill headed your way.

Prescription drug coverage and costs

Medication costs can make or break your healthcare budget. Most plans use a tiered system:

| Drug Tier | Description | Typical Cost |

|---|---|---|

| Tier 1 | Generic drugs | $5-20 copay |

| Tier 2 | Preferred brand-name | $30-50 copay |

| Tier 3 | Non-preferred brand-name | $60-100 copay |

| Tier 4 | Specialty medications | 25-50% coinsurance |

That specialty tier is brutal. A medication costing $2,000 monthly with 30% coinsurance means you’re paying $600 every month.

Some drugs aren’t covered at all, requiring prior authorization or step therapy (trying cheaper alternatives first). And pharmacy networks matter too – fill your prescription at the wrong place, and you might pay full price.

Affordable Care Act’s Impact on Insurance Costs

Premium Tax Credits and Subsidies Explained

Remember when health insurance used to cost an arm and a leg? For many Americans, it still does—but the Affordable Care Act (ACA) changed the game by introducing premium tax credits.

These credits work like an instant discount on your monthly insurance bill. Instead of paying the full premium, the government kicks in a portion based on your income and family size.

Here’s the deal: if your household income falls between 100% and 400% of the Federal Poverty Level (FPL), you qualify for these credits when buying insurance through the Marketplace. And since 2021, the American Rescue Plan temporarily removed that 400% cap, meaning more middle-income folks can get help too.

Let’s break down how much you might save:

| Income Level (% of FPL) | Expected Contribution (% of income) |

|---|---|

| Up to 150% | 0% to 4.0% |

| 151% to 200% | 4.0% to 6.3% |

| 201% to 250% | 6.3% to 8.05% |

| 251% to 300% | 8.05% to 9.5% |

| 301% to 400% | 9.5% |

| Above 400% | No cap (temporary relief) |

Cost-Sharing Reduction Subsidies

Premium credits help with your monthly bills, but what about when you actually need to use your insurance? That’s where cost-sharing reductions come in.

These hidden gems lower your out-of-pocket costs—think smaller deductibles, lower copayments, and reduced coinsurance. The catch? You must:

- Purchase a Silver plan through the Marketplace

- Have a household income between 100% and 250% of FPL

The savings get better the lower your income is. Someone at 150% FPL might get a plan that covers 94% of costs instead of the standard 70% for Silver plans.

Cost-sharing reductions happen automatically—no need to claim them on your tax return or fill out extra paperwork. They’re applied directly to your plan when you qualify.

Who Qualifies for Financial Assistance

The million-dollar question: Are YOU eligible for these savings?

For premium tax credits, you generally qualify if:

- Your income falls between 100% and 400% of FPL (or higher with temporary expansions)

- You purchase coverage through the Health Insurance Marketplace

- You’re not eligible for affordable employer coverage

- You’re not eligible for Medicaid or CHIP

- You file taxes jointly if married

For cost-sharing reductions, the rules are stricter:

- Income between 100% and 250% of FPL

- Enrollment in a Silver plan

In 2023, the Federal Poverty Level for a single person is about $14,580, meaning you could qualify for premium help with incomes up to $58,320 (or higher with current expansions).

What trips people up? Many don’t realize that “affordable” employer coverage only needs to be affordable for the employee—not dependents. This “family glitch” has left many spouses and kids without assistance.

Strategies to Reduce Your Health Insurance Expenses

How to compare plans effectively

Health insurance plans have more moving parts than a Swiss watch. Don’t just look at the monthly premium – that’s like buying a car based only on its color.

Start by understanding the total cost equation:

- Premium (what you pay monthly)

- Deductible (what you pay before insurance kicks in)

- Co-pays and coinsurance (your share of costs after the deductible)

- Out-of-pocket maximum (your financial safety net)

The plan with the lowest premium often comes with higher deductibles and co-pays. If you visit doctors frequently or take prescription medications, a higher premium plan with lower out-of-pocket costs might actually save you money.

Check if your doctors are in-network. Seeing out-of-network providers can double or triple your costs. And verify your medications are covered in the plan’s formulary.

Using health insurance marketplaces to find deals

The Health Insurance Marketplace (Healthcare.gov) isn’t just a website – it’s your ticket to potential savings. Many people don’t realize they qualify for premium tax credits that can dramatically slash monthly costs.

In 2023, about 80% of Marketplace enrollees found plans for $10 or less per month after tax credits. That’s less than your streaming subscription!

State-based marketplaces can offer additional savings programs beyond federal subsidies. And they let you compare plans side-by-side from different insurance companies – something you can’t do on individual insurer websites.

Timing your enrollment during open enrollment periods

Missing open enrollment is like missing your flight – expensive and frustrating. The federal Marketplace open enrollment typically runs November 1 through January 15.

But did you know about Special Enrollment Periods? Major life events like losing coverage, moving, getting married, or having a baby qualify you to enroll outside the standard window.

Mark these dates on your calendar and set reminders. Insurance companies count on people forgetting and defaulting to their current (often more expensive) plans.

Employer benefits optimization strategies

Your workplace benefits package might be hiding serious savings opportunities. Many employers offer Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) that let you pay for medical expenses with pre-tax dollars – effectively giving you a discount equal to your tax rate.

Ask about wellness program incentives too. Some employers offer premium discounts of up to 30% for participating in health screenings or fitness programs.

Consider your spouse’s plan – sometimes family coverage through one employer is cheaper than individual coverage through both.

Health care sharing ministries as alternatives

Healthcare sharing ministries aren’t insurance, but they function similarly for some families. Members contribute monthly and share each other’s medical expenses based on a set of guidelines.

The monthly share amount (similar to a premium) is often lower than traditional insurance, but these programs have limitations:

- They may exclude pre-existing conditions

- They’re not required to cover essential health benefits

- They’re typically faith-based with lifestyle requirements

- They’re not guaranteed to pay claims

Finding Hidden Health Insurance Discounts

Insurance companies hate when people know these tricks. Ask specifically about multi-policy discounts if you bundle with auto or home insurance. Some insurers offer up to 15% off for combining policies.

Professional associations and alumni groups often negotiate group rates for members. Check with organizations you belong to – savings of 5-10% aren’t uncommon.

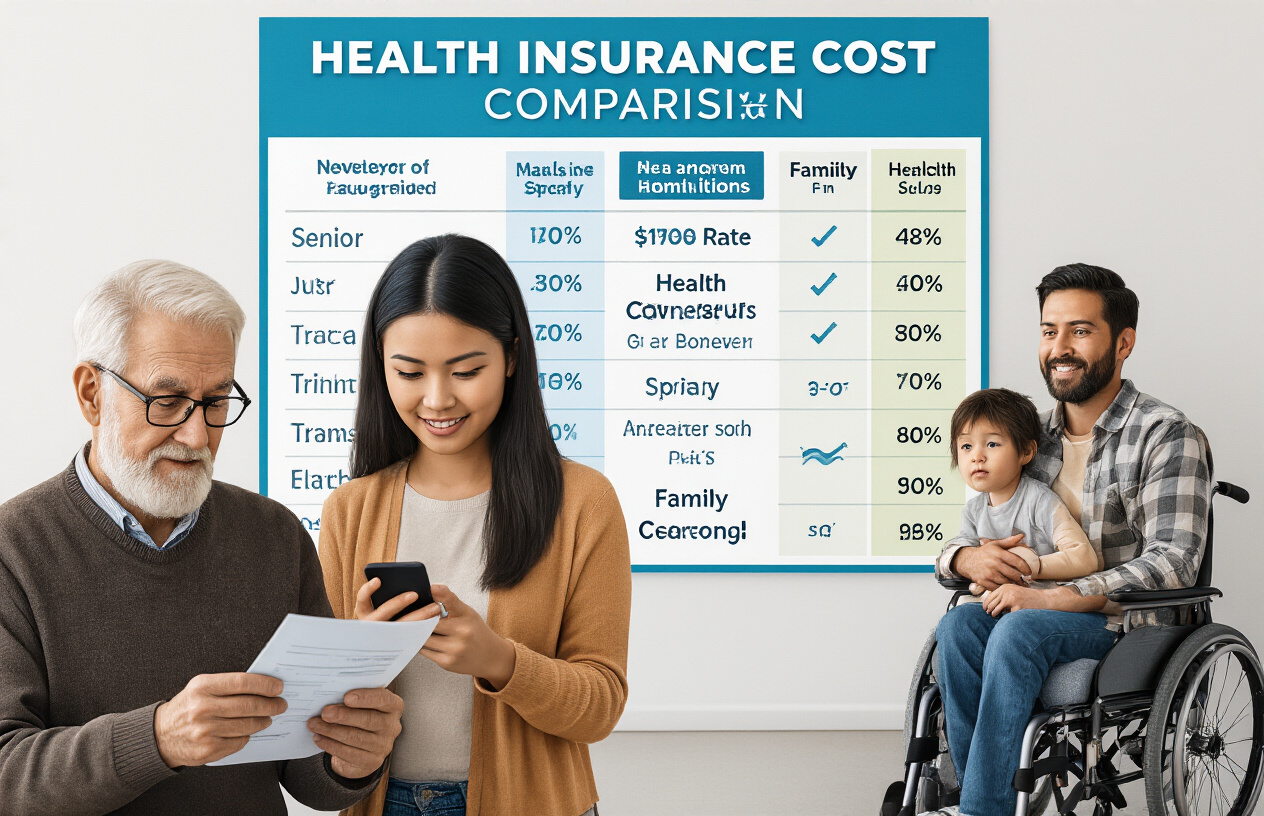

Special Considerations for Different Demographics

A. Family coverage cost considerations

Family health insurance in the USA? Brace yourself for some sticker shock.

When you add kids to your plan, costs skyrocket. The average family premium hits around $22,463 annually, with employers typically covering about 71% of that. This means families still pay about $6,500 out of pocket for premiums alone.

But wait – that’s just the beginning. Factor in deductibles (often $3,000-$8,000 for family plans), copays, and coinsurance, and a family could easily spend $10,000+ before insurance really kicks in.

Family size matters tremendously. Adding each child increases your premium, though many insurers cap this at three children. So whether you have three kids or six, you might pay the same premium (small victory!).

Age affects family rates too. Since the ACA allows children to stay on parents’ plans until 26, many families with college-age kids save significantly compared to purchasing separate policies.

Your location? Massive impact. A family in Wyoming might pay double what a similar family in Minnesota pays. No joke.

B. Insurance costs for self-employed individuals

Being your own boss means buying your own health insurance. And it’s not cheap.

Self-employed folks pay the entire premium themselves—no employer picking up 70-80% of the tab. The average individual market premium runs about $456 monthly for a single person, but expect $1,200+ monthly for family coverage.

Tax breaks offer some relief. Self-employed health insurance premiums are typically tax-deductible, potentially saving thousands annually.

Many self-employed people opt for higher-deductible plans with HSAs (Health Savings Accounts). The trade-off: lower monthly premiums but higher out-of-pocket costs when you actually need care. But those HSA contributions are tax-deductible and grow tax-free.

Professional associations sometimes offer group rates. Writers, real estate agents, and other professional groups often provide access to more affordable plans than individual marketplaces.

C. Student health insurance options and costs

College students face unique health insurance challenges.

Many universities offer student health plans averaging $1,500-$2,500 per academic year. These plans often provide decent coverage with convenient on-campus care, but watch for coverage gaps during summer breaks.

Staying on parents’ plans until 26 remains the most cost-effective option for many students, essentially costing nothing extra if parents already have family coverage.

For international students, university plans are often mandatory and cost $1,000-$2,000 per semester.

Medicaid expansion has been a game-changer for low-income students in participating states, offering comprehensive coverage at little to no cost.

D. Early retiree strategies before Medicare eligibility

The years between retirement and Medicare eligibility at 65 can be financially treacherous.

Early retirees pay astronomical premiums—often $800-$1,500 monthly for individual coverage—without employer subsidies. And these costs increase with age.

COBRA offers temporary relief, letting you keep your employer plan for up to 18 months, but you’ll pay the full premium plus a 2% administrative fee.

ACA marketplace plans with income-based subsidies have become lifelines for many early retirees. If you can manage your retirement income (through careful withdrawal strategies), you might qualify for significant premium subsidies.

Some retirees find part-time work primarily for the health benefits, working just enough hours to qualify for group coverage.

The labyrinth of health insurance costs in the USA can be overwhelming, with various plan types offering different coverage levels at vastly different price points. Beyond the visible monthly premiums, policyholders must navigate deductibles, copayments, and out-of-pocket maximums that significantly impact the true cost of healthcare. While the Affordable Care Act has provided subsidies and expanded coverage options for many Americans, healthcare expenses remain a substantial financial consideration for individuals and families alike.

Taking proactive steps to manage your health insurance costs is essential in today’s healthcare landscape. Consider carefully evaluating your healthcare needs before selecting a plan, exploring employer-sponsored options when available, and utilizing preventive care services that are typically covered at 100%. Remember that costs vary significantly based on age, location, and health status, making personalized research crucial to finding the most cost-effective coverage for your specific situation. By staying informed and strategically approaching your healthcare choices, you can secure necessary coverage while minimizing financial strain.